Catalytic Connections

Crafted for entrepreneurs, owners and new capitalists in this epic time of transformation.

Special Series

August 2020

We all know deep changes are setting in. This issue is an overview of matters on my mind. All information is gleaned from my favorite business news sources: The Wall Street Journal, The Economist, HBR, Fast Company, Inc., NY Times, and Wired.

Life Shaping Things to Watch

Business Bullies

Amazon accounts for more than a third of U.S. online retail sales, and has seen its market value soar above $1.5 trillion this year.

When Amazon.com venture capital fund invested in DefinedCrowd, it gained access to the technology startup’s finances and other confidential information. 4 years later they started a near identical artificial intelligence product. This is one of more than 2 dozen such scenarios using the investment and deal making process to develop competing products.

Amazon intimidates everyone with its arrogant, greedy and aggressive ways. Its unbridled ambition to own, control and dominate the market reflects the ugly side of capitalism. This does not bode well for free enterprise, in my opinion. Sounds more like communist China to me, but I might just have a chip on my shoulder because I am not as smart or big or rich as Jeff. And, I do like their next day delivery.

Small Business

The pandemic took a particular toll on black-owned businesses. They were especially hard hit by coronavirus because of a combination of geography, limited reach of a key federal aid program, and weaker ties to banks.

In 2016, JP Morgan Chase Institute found that the median small business holds just 27 days of cash on reserve. For restaurants, retail shops and construction firms the buffer is thinner.

This small food empire—restaurant, thriving catering business, and family farm—is rethinking how to survive.

“This isn’t a restart. This is a startup…The model has changed so much, it is a new company.”

The pandemic has brought structural changes to how business operates. More businesses will start to invest in digitizing their workplace infrastructure.

Small businesses are bracing for a long crisis, facing two harsh realities: lack of cash and loss of sales. Implications for every leader:

Those who survive could have new opportunities.

Like a dust storm where the path is unclear, missteps are likely.

The best thing we can do right now is acknowledge we don’t have the answers.

Success Attributes: adaptability, propensity to learn.

What is the Money Moving Toward?

Hedge fund managers are aggressively launching funds for exponential growth companies. Cash holdings of U.S. public companies amounted to $2.54 trillion at the end of Q2, up from $1.96 trillion at the end of 2019 and $1.86 trillion from the second quarter in 2019, according to S&P Global Market Intelligence.

The pandemic has created a divide between corporate haves and have nots:

Strong cash and cheap credit for Haves

Chapter 11 filings up 30 % for Have Nots

The big corporations with strong balance sheets are going to grow bigger through acquisitions. This will be good for small, tech-centric businesses with niche plays that can scale.

Here is what the Private Equity investors in my world are looking for:

New ideas with breakthrough potential that can prove market viability and become a hot target for a platform company

Smart, experienced teams with a trustworthy leader, a niche, a desire to make a move on the market, and a need for growth capital

Enterprises in a significant owner transition and underdeveloped growth

Big disruptors driven by new technology, new partnership, and new platform

Industry Sector Analysis

Technology

Big tech keeps getting bigger despite concerns about size and influence.

Facebook’s users are increasing engagement. Revenue is managing to grow but rate of increase is declining and is expected to stay low. Facebook’s non-advertising business, which includes virtual reality division Oculus and Portal, its home video calling device, was an exception to the slower growth with sales rising 40% from a year ago.

Tinder Owner (Match Group) has lit up the pandemic. In addition to soaring engagement, Match said it has seen a recovery in subscriber conversion and average revenue per user since early May.

Intel Capital, with about 300 portfolio companies, has invested in areas including: artificial intelligence, autonomous vehicles, 5G telecom, data centers, and cloud.

Marketing/Advertising

Publicis Chief has sent a warning to the ad and media industry saying this crisis will be unprecedented by its magnitude, complexity and length.

The pandemic is upending the events industry. Hard hit by recessions, exhibitions are lagging behind the broader economic recovery. It took a decade to recover from the 2008 financial crisis. Many virtual events are free, and sponsors are not so keen to spend money on them.

The Wall Street Journal is beginning to define the Pandemic Consumer. The big question is how many of these new consumer habits will endure permanently as the country inches back to something that resembles normal life.

“The three-month period we are going through is going to equate to three years of consumer changes wrapped up in one quarter.”

Winners Now

Clorox

Amazon

Hasbro Gaming

Netflix global streaming

PepsiCo

Losers Now

Delta

Estée Lauder

Newell’s home and outdoor sales

Starbucks’ same store sales

McDonald’s

Healthcare

Researchers are racing to develop a COVID-19 vaccine, and investors are in a mad dash to profit from it. Drug maker, Novax, got $1.6 B from Uncle Sam for clinical trials and large scale vaccine manufacturing. This will allow for production of 100 million doses of the vaccine by end of year. Novavax shares will surge 32% . Likewise, Regeneron Pharmaceuticals got a $450 M federal contract.

Cautions:

Most drug candidates in development don’t reach market.

Pricing power may not be as strong as investors hope.

Requirements to make money are high efficiency and a very high safety rate.

The weight of politics encumbers the speed to market.

Predictions:

Visions of windfall profits are more of a dream than a reality. Additionally, there may be minor reductions in revenue, but larges drops in high profit services, such as elective procedures and emergency room care.

The duration of the effectiveness of a COVID-19 vaccine is uncertain. If any of the most advanced vaccines prove to work safely, they may only protect people for months or years rather than the rest of their lives.

Energy

Not only has the crash in oil prices affected jobs, but it has also affected capital investments made by the oil industry trading firms. These numbers are reflected in the futures market. Moreover, energy companies that were major issuers of junk bonds to finance expansion now can’t pay their debts.

A year ago, this West Texas region was one of American’s hottest labor markets, fueled by a fracking gold rush. Today the oil field is all but shut down.

Travel

Passenger volumes have plummeted 95% in the US while Airlines are burning through cash. Projections expect a choppy and sluggish recovery, and a rebound is a minimum of 3 years away, depending on lots of assumptions.

Real Estate

As the pandemic leads to broader adoption of permanent work-from-home policies, Zillow and Refin are reporting surges in single family home searches.

Houses may be the top asset class again

21% want more space to work from home

21% want more outdoor space

7% want a place for children to learn from home

Moody analytics REIS estimates that the value of office buildings across the U.S. will fall by 17.2 % in 2020. This is not far from the estimated 19.2% drop for retail and the 20.5% drop in lodging.

Hotels, shopping centers and senior housing communities are hurting as well, but the pandemic is providing an extra boost to landlords leasing to biotechnology, pharmaceutical and other life science businesses.

Cash is pouring into distressed real estate funds as commercial property sales become nearly inactive and values plummet. Firms have shifted focus to commercial real estate debt, dumped by troubled lenders, by raising billions in funds to buy distressed debt.

The commercial real estate industry is expected to remain under severe stress, even after lockdown. 11% percent of commercial mortgages will be converted into securities. This will surpass the highest level that was hit during the last financial crisis, 10.3%.

Companies owning huge pools of rental houses are weathering the economic shutdown far better than feared.

Manufacturing

US manufacturing has seen hard times before, but not like this. They are much more globally integrated than most businesses. From semiconductor makers to surgical gown producers, companies are reassessing multinational production networks that have proven vulnerable to disruption.

Robots have been drafted to the front lines of delivery services. The pandemic has turned businesses, governments, and consumers from cautious beta testers to eager early adopters.

Durable goods orders have plunged as consumers’ economic views have soured. Overall orders for durable goods—products designed to last at least three years—were down 14%. Sales on vehicles, aircraft, defense, and spare parts all are taking hits.

Conclusion: Economists at Oxford Economics expect manufacturing output to return to pre-pandemic levels no sooner than 2021.

Retail

The growing list of Chapter 11s incudes:

Ann Taylor/LOFT/Lane Bryant

EarthFare

Pier1 Imports

Chuck E. Cheese

Men’s Wearhouse/JoS. A. Bank

Papyrus

J. Crew

Neiman Marcus

Stage Stores

J.C. Penney

Tuesday Morning

GNC

Stein Mart

Lucky Brand

Brooks Brothers

Sur La Table

Lord & Taylor

New York & Co.

Profits slide in luxury stores:

Fashion and leather goods - 23%

Selective retailing - 32%

Perfumes + Cosmetics - 29%

Wines and spirits - 20%

Watches and jewelry - 38%

Walmart has seen changes in shopping patterns. In this article CEO, John Furner talks about the retail giant’s shift to e-commerce and how the pandemic has helped with energizing customer focus. Customers over the age of 50 are Walmart’s fastest growing group of online pickup shoppers.

Chipotle has tripled its online sales. Digital orders make up 61% of revenue as the company builds more drive through sites. Starbucks posts its worst loss in more than a decade with a $3.1 billion loss of sales, reporting that same-store sales are down 40%.

Expected rebound: more to-go-only stores.

Finance

The World Bank predicts that the global economy would shrink to 5.2% this year.

The mortgage market has held up surprisingly well as the coronavirus pandemic has battered the U.S. economy. This article shows a glimpse into the numbers ahead of Rocket Mortgage’s IPO. The Quicken Loans offshoot is trading at 10 times its estimated net income over the past 12 months. Most don’t anticipate the “fuel” of refinancing income to last; instead we can expect an estimated 25% drop in mortgage originations in 2020 to 2021 and a 50% reduction in refinancing volume.

Additionally, mortgage availability has tightened sharply as lenders have started imposing tougher income, credit score and down payment conditions. A strained mortgage market is threatening to make the economic recovery more difficult.

The largest banks signaled the worst of coronavirus is yet to come as they are expecting 10’s of billions of losses from loan defaults.

In Q2, Goldman Sachs Group recorded the second highest quarterly revenue at $13.3 billion, gaining profits with a flood of corporate fund-raising deals and torrid trading markets. This is part of the answer to reconciling a stumbling economy with a rallying stock market: companies are lining up for cash in prep for the big downturn in the months ahead.

Commodities

Global investors are piling into bullish wagers on copper prices, sparking the quickest rally in the industrial metal in years and signaling that many money managers remain hopeful about the economic outlook despite rising coronavirus cases in the US.

Because copper is widely used in the global manufacturing sector and is critical to making everything from smartphones to houses, many market-watchers use its price as an economic indicator. The metal is closely linked to growth in China in particular. The world’s second-largest economy consumes roughly half of the world’s copper, and recent data indicate a growth recovery there that is stronger than any analyst anticipated after the coronavirus shut down Chinese manufacturing early in 2020.

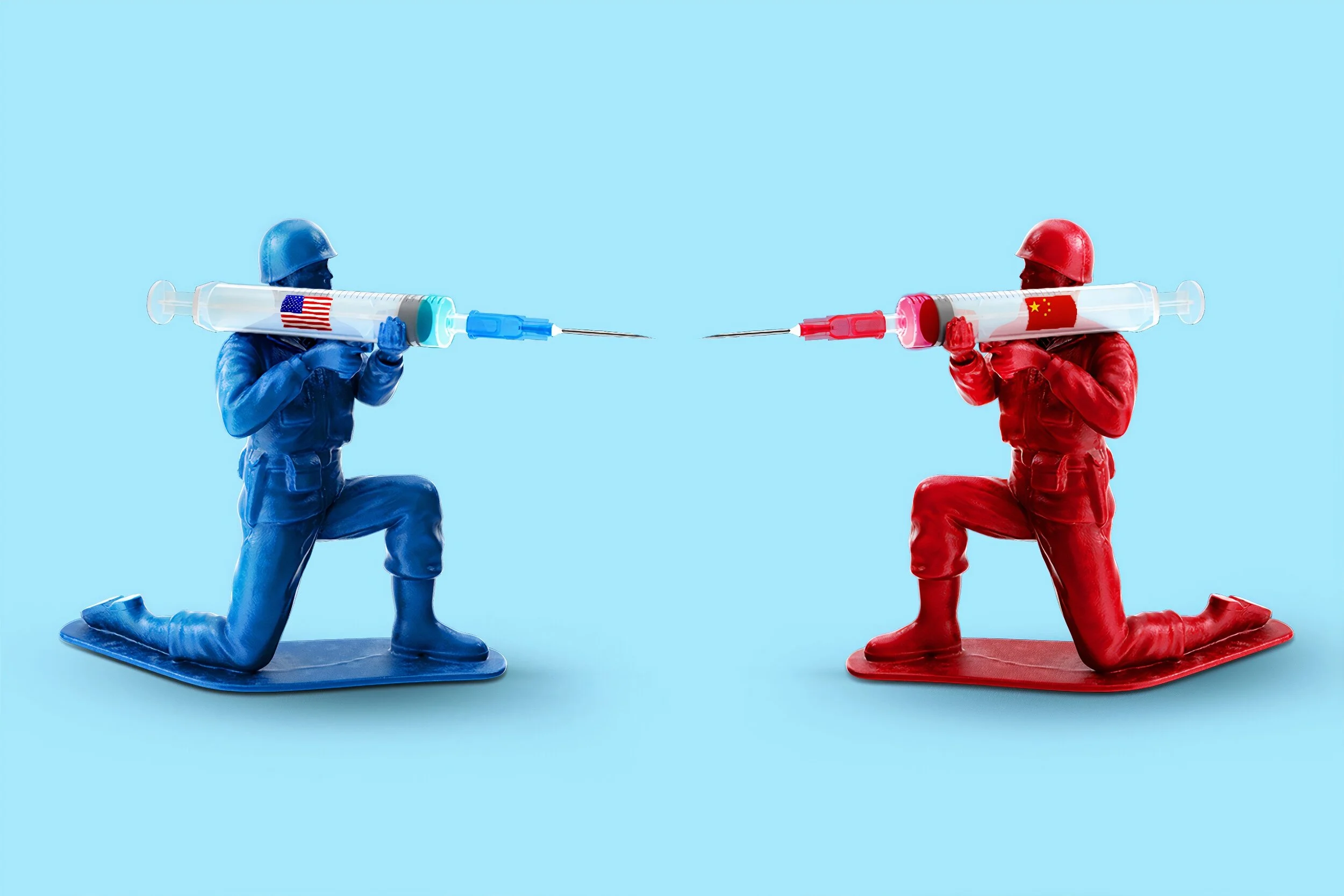

China

The pandemic lays bare U.S. reliance on China for drugs. Disruptions and high demand expand the concern for our supply of medicines.

Acetaminophen is one of a slew of life-or-death ingredients for medicines that is produced in significant amounts in China, 70% of which are used by the US. Commodity chemical companies in the US are unprofitable.

In February 2020, a Gallup poll reported that 67% of Americans have an unfavorable opinion of Beijing. Why?

The communist government has a history of abusing intellectual property and human rights.

Beijing has closed its markets and cheated in its economic competition with the US. American businesses have complained that Chinese hackers have stolen trade secrets and that Chinese officials have forced them to hand over technology.

China’s business subsidies fuel excess production of goods, which spill into global markets, depressing prices and making it nearly impossible for American companies to compete. Read more about why this is an issue here.

Now the US must find a way to produce the medical supplies and PPE it previously sourced from China to fight a virus that Beijing’s deception unleashed on the world.

“Every crisis is a spiritual crisis and raises deep questions about the goodness of the organization and the people in it. ”