Catalytic Connections

News and trends curated for entrepreneurs, owners and new capitalists in this epic time of transformation.

Special Series

September - October 2020

This issue is an overview of matters on my mind, gleaned from my favorite business news sources: The Wall Street Journal, The Economist, Harvard Business Review, Fast Company, Inc., The New York Times, and Wired.

On the Minds of Leaders

I am glad you opened this issue of Catalytic Connections because it means you are seeking, like me, to make sense of the chaotic world we share. The world needs courageous, humble thought-leaders. The news is growing angrier, the field conditions murkier, and margins for error smaller. All people are wearier.

As leaders we must get in front of these waves — watch for patterns and follow the private capital. Smart leaders make decisions after thoughtfully observing everyday events, considering economic laws, watching how money flows and using their God-given sense of right and wrong. May this issue fortify your leadership.

Owners Alert: You need to protect your cash access if you are the owner or executive in charge. Don’t leap on new partnerships, but look for synergistic relationships that can ease cash needs and increase access. Make sure you can untangle or walk away unharmed from any contractual agreements. Turbulent times are not good for making long-term commitments.

Here we go...news, factoids and more.

Life Shaping Things to Watch

Economic Realities

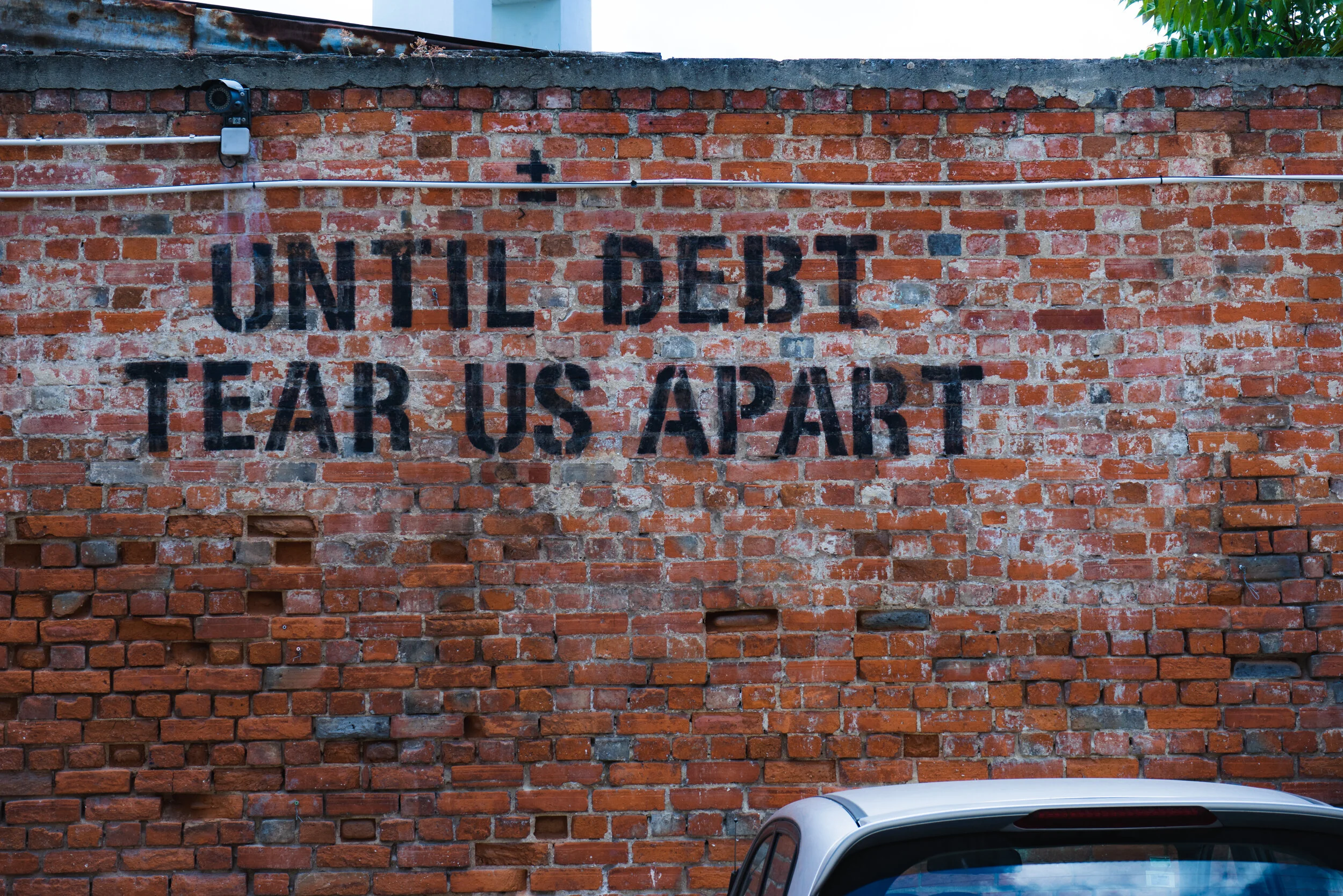

The US federal debt is expected to reach and possibly exceed 100% of gross domestic product by the fiscal yearend on September 30th. The last time the federal debt was larger than the sum of the nation’s annual economic output was in 1946, shortly after WWII ended. More than $6 Trillion has been spent this financial year — nearly $3 Trillion on COVID relief — double the $3 Trillion generated from taxes.

Investment banking and trading revenues hit an eight year high in the first half of 2020, a counterintuitive boom that shows the heavy hand of the Federal Reserve and a growing gulf between financial markets and the economy.

Small Business

We know that the stock market is not the economy. This has become even more clear in 2020 as Wall Street stayed healthy while Main Street has suffered. The corner bars, family restaurants, the hair salons and other small U.S. businesses that are teetering or closing for good, aren’t listed on the stock market.

“Main Street is the Now, Wall Street is the Future.”

Private Equity

Companies will need capital to survive and manage through the downturn to rewire operations, reallocate resources and, in many cases, reinvent their business models. This article discusses how joint ventures can use restructuring tools that wholly owned businesses cannot.

Three types of collaborative ventures can help companies raise capital, lower costs, and position themselves for future growth:

Consolidations to reduce operating and capital costs

Partial sales to shore up balance sheets

Partnerships for capital-light growth to pursue opportunities

Business Pivots

When it’s time to pivot, every business needs a story to sell its stakeholder. A story with strategy, finesse and purpose. This HBR article tells us how to think about crafting the way we communicate through a pivot.

What is the secret to building a breakthrough business?

The classic academic answer: Identify a weakness in an existing category, niche service or product, and offer a unique and valuable product. Then wrap your offering with new words, symbols and ideology.

The new innovators just might need to think neo-classically. Like Dan Carlton, owner of The Paragraph Project. I love how Dan thinks. So much so that we’ve formed a new business model re-invention lab. We call it Revealed. Keep your eyes peeled for its launch, and we will tackle some of these pressing questions:

Where do we start to re-start?

Are there steps to follow in leading an enterprise through a re-invention? A strategy?

What are we called to do that is unique to our team’s DNA that can’t be taken away?

If we could magically meld the best of the minds on our team, is there a diamond below the piles of disruptive clutter?

How do we communicate our story to the stakeholders of our business to inspire confidence in our future?

Industry Sector Analysis

Technology

The businesses that are thriving now were prepared for a world of touchless transactions, automation and decentralization—from toolmakers to pizza chains.

Square Inc.’s Cash App has fueled a leap in their stock prices – shares are up 166% since the beginning of 2020. Cash App allows users to digitally store and transfer money like a bank. Recently, Square Inc. announced new payroll features to increase Cash App’s banking business even more: On-Demand Pay for employees and Instant Payments for employers.

Healthcare

Walmart hosted more than 600 COVID-19 testing sites. This decision dovetails with its ambitions to become a larger provider of health care services.

Despite a decline in membership from employer plans caused by layoffs, the pandemic delivered profits for UnitedHealth. The insurer’s costs dropped sharply because of widespread cancellation of medical procedures and routine healthcare.

Marketing/Advertising

In August, the The New York Times predicted a $1 Billion disruption in TV ad revenue due to postponed college football schedules. Now, advertisers are pressing for flexible contracts with TV networks that would allow them to back out of commitments due to program changes and football disruptions caused by coronavirus.

Political campaigns are increasingly turning to ads on digital streaming services like Hulu and Amazon Prime Video because they are cheaper than traditional TV spots and more efficient at targeting specific voter groups. On the other hand, social media platforms that were once a prime spot for political ads have limited and or even banned political advertising.

“Political-ad buyers often use streaming services and devices’ personalization capabilities to target voters based on household income, education level, number of children or veteran status.”

Media

McClatchy Co., a 163-year-old family-run media company, emerged from bankruptcy on September 4 with a new owner: Chatham Asset Management. Digitalization has caused insurmountable headwinds for the print advertising revenue that once sustained larger newsrooms. With coronavirus coverage, local news became increasingly more important, but there are still challenges ahead.

“Your business model is literally throwing yesterday’s news at people’s houses. How long do you really think that will last?”

- Craig Forman, departing CEO of McClatchy

Real Estate

Nearly 1 in 4 hotels nationwide face possible foreclosure as owners fall behind on monthly loans. This article describes how hotel owners have cut to the bone to weather COVID-19, but many still haven’t cut deep enough.

Even with the cost-cutting, many amenities remain dark, including: spas, pools, and gyms. A full-service hotel with 300 rooms is losing an average of $4,500 dollars every night, according to STR calculations. That’s before adding the fixed costs the hotel can’t shed such as management fees, taxes, and debt.

According to a report by Oxford Economics, there will be an estimated loss of $16.8 Billion in state and local tax revenue from hotels in 2020.

Developers see an opportunity in converting hotels into retirement communities — it is half the price to convert a property instead of building from the ground up.

According to The New York Times, the changes expected in commercial real estate over the next 18 to 24 months are on a scale that far exceeds any we have seen. 172 million square feet of Class A office space is expected to come online this year and next. Only 59% of it has been leased, below the average of 74%. If there is a major pullback in office space usage, that could have significant economic impact. A 5% increase in unused space in central business districts would see office net operating income market value drop by 23%, on average, according to Moody’s.

Causes of the oversupply in commercial real estate predate the pandemic, like:

Shift to e-commerce: 10,200 stores closed in 2019

Rising digitization: more telecommuting

Demographic changes: younger populations are more comfortable with remote access and less office space. According to Moody’s Analytics, the average square feet needed per employee in 1980’s was 200-300, in 2019 it had fallen to 126.

Amazon has capitalized on this opportunity by purchasing the Lord & Taylor building on Fifth Avenue with plans to convert it into office space for 2,000 employees by 2023. Similarly, WSJ reports potential plans to convert JC Penney and Sears stores to distribution warehouses.

Retail

Some retailers saw skyrocketing demand from consumers and weren’t prepared to handle the influx.

Consumer packaged goods companies like Unilever and Proctor & Gamble have struggled to keep up with out of stock items as products fly off the shelves.

Early in pandemic, Amazon retooled its website so buyers would buy less because it struggled to handle the massive surge of orders.

Macy’s is positioned for survival post-pandemic while competitors like J. C. Penney and Lord + Taylor are failing. They were able to hire a new digital talent team to handle the increase in online sales while stores were closed. Digital sales accounted for 43% of total sales in the spring quarter, up from 25% before the pandemic.

“We do believe there is lasting change to shopping behavior as customers will continue to expect a true, safe, convenient omnichannel shopping experience.”

WSJ issued a “business report card” discussing performance of the above retailers among other companies in 2020.

The pandemic’s effects on grocery-anchored real estate has put a premium on more convenient-oriented pickup and delivery features. Another outcome is movement toward reconfiguring of space from display areas to bulk storage and easy to access inventory space.

Real estate experts say a shift from retail to more industrial uses will require a haircut on asset prices of about 25 to 30 percent to account for the differences in leasing rates.

Education

The shift to remote work and remote learning is seen by Hampleton Partners as a long-term play as we see a growing demand for remote collaboration tools and remote-work apps.

For higher education, it seems to be the perfect storm of trouble. Colleges have their hands full this Fall Semester: new costs, old concerns, and no time as America’s colleges are under financial strain. Moody’s Investor Service is predicting significant drops in per student revenue—between 5 to 13%, and this is expected to rise. The social distance rules compound the economic math as few students are allowed to share physical space.

Predicted costs spikes:

Retrofitted classrooms

Screening gear/medical tests/wellness kits

HVAC system overhauls

Potential revenue decline hot spots:

Decreased enrollment

Fewer housing needs

Limited or no dining plans

Industry watchers predict 10% to 20% of small private colleges and the weaker regional public institutions could close in the next 12 months.

We can expect a surge in students heading to community colleges as they look for cheaper options closer to home. On the other hand, Forbes is reporting a mixed bag, with some enrollment upticks among some larger state schools and sharp declines among others.

Global Outlook

China

China indicated it may dump American treasuries if tensions between Washington and Beijing continued to escalate. Despite the coronavirus, China is still a manufacturing powerhouse. Chinese manufacturers have opened additional facilities in other Asian countries, minimizing risk and avoiding the tariffs imposed on Chinese imports to the US.

In 2010, after visiting China, I wrote an article forecasting how the nation would evolve over a decade and predicting where China would be in 2020. Read the full article here.

Developing Nations

In developing nations with few tools at their disposal, coronavirus contractions and lockdowns have caused economies to reel. This article discusses how coronavirus has been a setback to the gains against poverty. The longer the pandemic drags on, the longer the economic pain.

Business Model Transformation

Once-niche services like telehealth and online education, which came into their own during lockdowns, will be more important in the future.

Big Disruptors

Hot issues on the minds of enterprise leaders:

What the pandemic has taught us about Artificial Intelligence

The outlook for digital enterprises

Navigating the ethical issues

Finding talent in this time